Pillar 3a

Occupational pension provision (2nd pillar) has been under pressure for years. Factors to be mentioned here include demographic trends, increasing life expectancy, current (too high) pension benefits, the low interest rate environment in the financial market and statutory investment restrictions. As a result of these factors, the interest rate on saved pension assets in the 2nd pillar has fallen continuously in recent years, and pension conversion rates are also being adjusted downward on an ongoing basis. Not to mention the high cross-financing of current pension benefits by today's contributors. And yet - the 2nd pillar remains one of the most important pillars in retirement provision. Due to the aforementioned problems in the 2nd pillar, tied free pension provision (pillar 3a) is becoming increasingly important.

Pillar 3a is the individual retirement provision and is promoted by the tax privileges of the federal government, cantons and municipalities. By paying into pillar 3a, retirement provision can be improved and the tax burden reduced. Every franc paid in can be deducted from taxable income. The annual contribution is limited to CHF 6,883 (from 2021) for self-employed persons and employees with a pension fund connection. Employed persons without a pension fund connection can pay in up to 20% of their earned income annually, but no more than CHF 34,416 (from 2021). Contributions may be made up to a maximum of five years after reaching the normal retirement age if you are gainfully employed.

The 3a credits can be withdrawn at the earliest five years before age 64 for women and age 65 for men. If employment is continued for a longer period (beyond the normal retirement age), the retirement assets must be withdrawn at the latest by age 69 for women and age 70 for men. Under certain circumstances, early withdrawal before the age of 59 or 60 is possible. For example, in the event of the purchase or renovation of owner-occupied residential property, the commencement of self-employment or emigration (the list is not exhaustive).

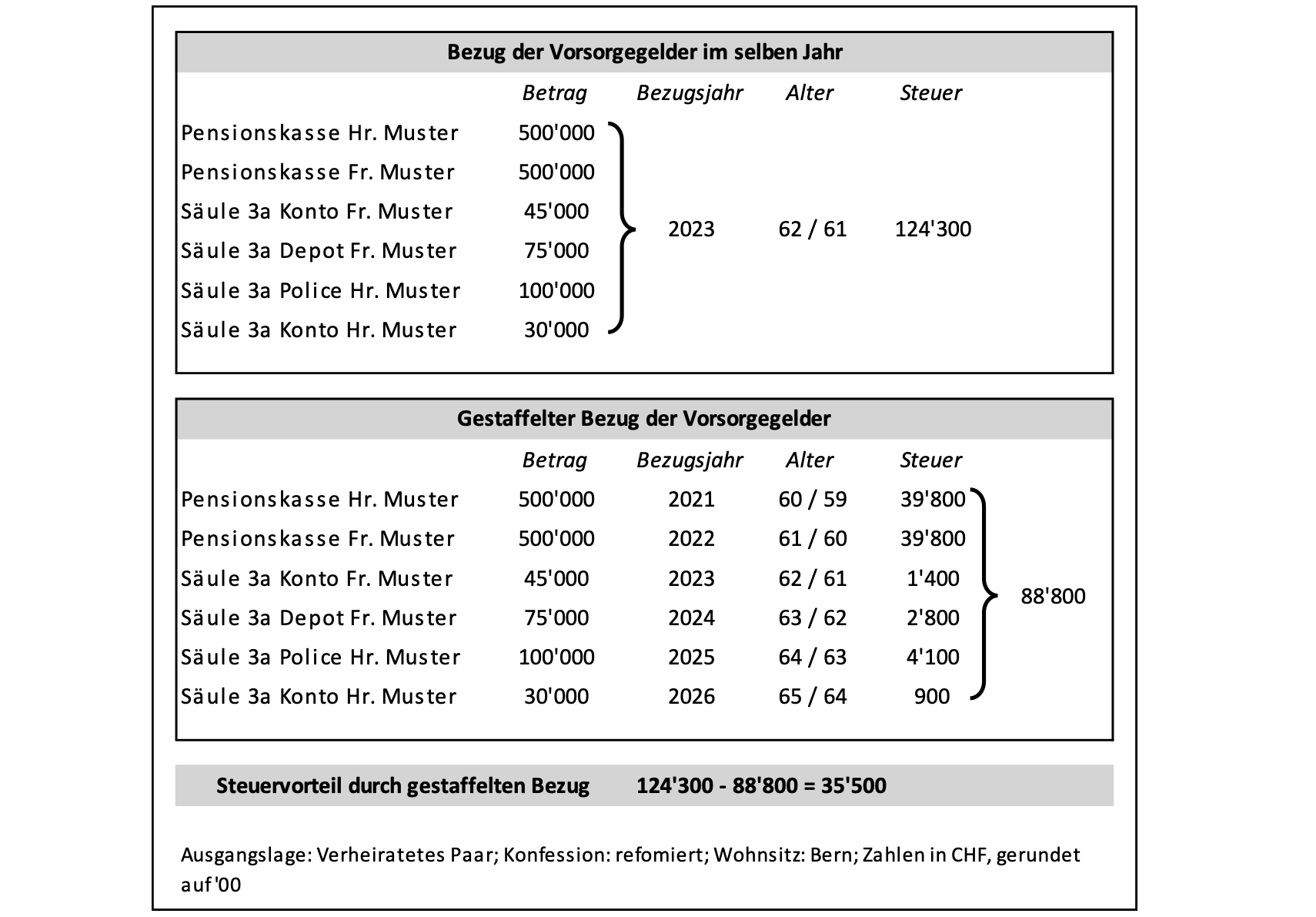

When the 3a assets are withdrawn, the capital is subject to a capital payment tax (analogous to the 2nd pillar). The amount of the capital payment tax depends on the amount paid out. Due to the progressive tax rate, the larger the amount, the greater the tax burden. Therefore, the withdrawal of pension assets should be staggered over different tax periods. It is important to coordinate the withdrawal of the 3a assets (account, securities deposit, insurance policy) with the withdrawal from the 2nd pillar (pension fund, vested benefits) (see table below).

Since the withdrawn 3a assets are added to the taxable assets after withdrawal, it is worth delaying the withdrawal as long as possible. In this way, wealth taxes can be saved. However, it is also important to keep an eye on the tax advantages of staggered withdrawals.

If there is a lack of liquidity for optimization in the occupational pension plan (shortly before retirement), it may also make sense to withdraw your 3a assets and pay them into the occupational pension plan. It is important that the capital is first transferred to a private account before it subsequently flows into the pension fund. Although capital payment taxes are due on the withdrawn assets, the amount paid into the occupational pension plan can be deducted from taxable income. There is no taxable increase in assets. Savings turbo, as a reduced taxed withdrawal generates a full tax deduction!

The optimization option "withdrawal of pension assets 3a with direct purchase into the occupational pension plan" has been confirmed in the recently published Federal Supreme Court decision of May 14, 2020. If a lump-sum withdrawal from the pension fund is planned upon retirement, it is important to note that the last purchase must take place 3 years before the lump-sum withdrawal.

Occupational pension plans, tied pension plans 3a and taxes; a complex matter with many questions and answers, for which we will be happy to assist you in the context of a pension consultation.

Valentin Chiquet

Financial planning & pension consulting

BSc HES-SO in business economics

vch@core-partner.ch

AbaWeb

AbaWeb