Financial planning: a key instrument in business succession planning

Those who run an SME usually put a lot of heart and soul, working hours and energy into their company. There is no time for a detailed examination of private finances and their development, especially after giving up the business or handing over the business.

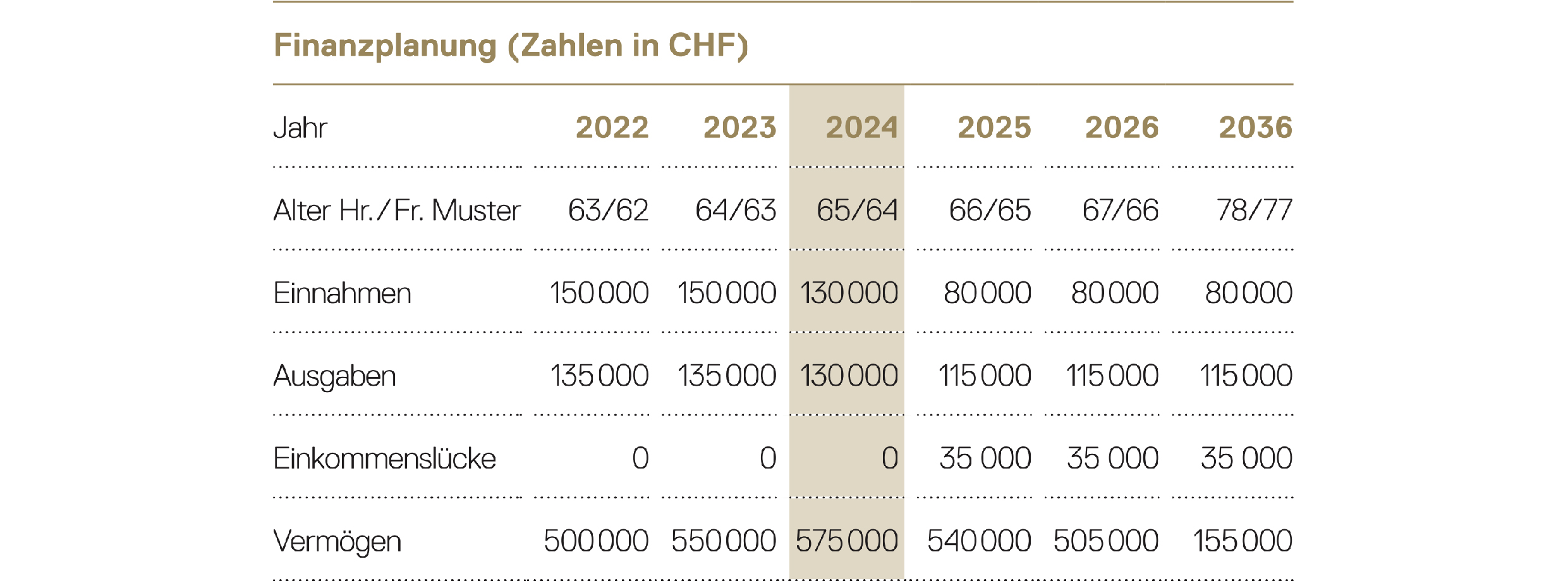

This is where financial planning comes in. We distinguish between business and private financial planning. Professional financial planning covers all relevant topics. In private planning, these include, for example, pension provision, taxes, real estate/mortgages, securities, inflation, estate planning and business succession. In business planning, it is important to map future trends, investments and financial flows in ongoing operations. This article focuses primarily on the private part. Specifically, the financial plan lays out income, expenditure and asset development on a time axis. In the highly simplified example, one can see how an income gap arises after the cessation of gainful employment (2024). This is because the income from AHV and pension fund pensions is often not enough to cover all the expenses.

The aim is to cover the income gap with saved assets (bank account, securities, pension assets, real estate, etc.) in order to be able to maintain the accustomed standard of living. The proceeds from the sale of one's own company also play an important role here, as for many entrepreneurs this forms a considerable part of their personal retirement provision. Basically, the question arises as to how high the company proceeds should be in order to finance retirement in the long term. This question should be addressed early on. We recommend drawing up an initial financial plan from the age of 45-50 at the latest, which can then be adjusted in phases as needed and coordinated with the company situation.

Once the asset requirements for financing retirement have been defined, the scope for a loan to the buying party or a payment in several instalments can also be determined for the transfer of the business. Financing support from the selling party can influence the success of the sale, as more interested parties will be considered. If the business succession is regulated within the family, the equal treatment of heirs or the observance of compulsory shares can make finding a solution more difficult. If there is clarity about the long-term asset requirements, possible gifts can be considered and thus the succession can be simplified. Particularly in the case of family-internal solutions, it is imperative that the inheritance arrangements are also addressed at an early stage.

Financial planning makes it possible to compare different options. One-off decisions such as the form of pension fund or the retirement date can be made in a well-founded manner and coordinated with the business succession. Goals are set realistically and measures such as the adjustment of the legal form, the drawing of salary and dividends, the adjustment of the pension fund, pension fund purchases or the removal of real estate from the company and its restructuring can be planned, scheduled and successfully implemented.

Planning is a dynamic instrument that should be periodically reviewed and adjusted as needed. It brings together several complex issues and allows them to be viewed as a whole and their interaction to be understood. The financial plan provides clarity and a good overview of possible developments and thus conveys a certain sense of security. Questions are addressed and clarified at an early stage. The entrepreneurs feel well prepared for the future and can fully concentrate on their entrepreneurial activity.

This article previously appeared in CORE Newsletter 31 of June 2022.

Valentin Chiquet

Procurator

Head of Pension Provision

BSc HES-SO in Business Administration

T +41 31 329 20 52

vch@core-partner.ch

AbaWeb

AbaWeb